The intangible nature of services

Publish date: 22 February 2019

Issue Number: 59

Diary: CompliNEWS

Category: General

By Lee Rossini

As financial planners, we seldom stop to think about the services we offer and how the nature of these services impacts on our relationship with our clients. The differences between goods (products) and services are important when developing a business model, marketing plan or client engagement process. Goods are tangible objects that can be created and sold or used later. A service, although more difficult to define, consists of economic activities such as product time, place, form or psychological utilities. Services are intangible acts, deeds or performances.

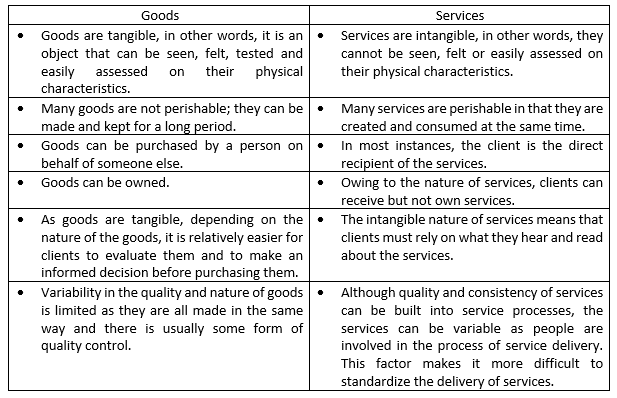

The main differences between goods and services can be summed up as follows:

Financial planning services are, by their very nature, intangible, inseparable, perishable and variable. When clients cannot experience a good or service in advance, they are buying promises. When we offer our clients financial planning services, we are promising to meet a need, address a concern or support the achievement of an aspiration which will ultimately result in satisfaction for the client. The way the services are packaged (how the promise is presented on a website, in a brochure or the branding of the business) and how the services are carried out by the staff are central to a financial planning business. These factors influence the client when deciding to use the services offered by your business or whether to use the services offered by a competitor who they feel is more suitable.

Although most goods and services are intertwined, financial planning services differs from most in that the ‘good’ (financial product) and the service are both intangible. The nature of these services and current levels of technology (think robo-advisor, the internet, self-help options) means that physical contact with a business is not strictly required by the client. To encourage continued engagement with clients, it is essential to focus on services which provide a positive, satisfactory and useful client experience. Ultimately, the services must live up to the promises made.